TRAINING & RESOURCES

for self-employed individuals and small business owners

COMMUNITY

for DIY bookkeeping and Making Tax Digital quarterly update support

SIGN UP FOR FREE

for bookkeeping tips, software demos and product news

About Springreach Training & Coaching

Jill Blofield FMAAT – Bookkeeping, Self Assessment and Making Tax Digital for Income Tax trainer.

Resources and support for UK self-employed individuals and small businesses.

Training & Resources

Top quality training and resources, clearly presented and explained, on topics of interest to self-employed individuals and small business owners. Monthly online bookkeeping support and accountability sessions.

FIND OUT MORE

Self-Employed Bookkeeping for Beginners

A step-by-step beginners’ guide to self-employed bookkeeping. This online course outlines an 8-step process to keeping good bookkeeping records, delivered through a combination of practical demonstrations, videos, templates and checklists.

Join the Springreach DIY Bookkeeping Community

A membership for self-employed individuals and small business owners. Membership includes a monthly online bookkeeping Q&A support and accountability session, masterclasses, templates, checklists, software demos and support with a range of software packages.

Sign up to our mailing list

Latest from Blog

For self-employed individuals, entrepreneurs, small business owners and bookkeepers – blogs on business and accounting matters, topical tax tips, and personal and professional development.

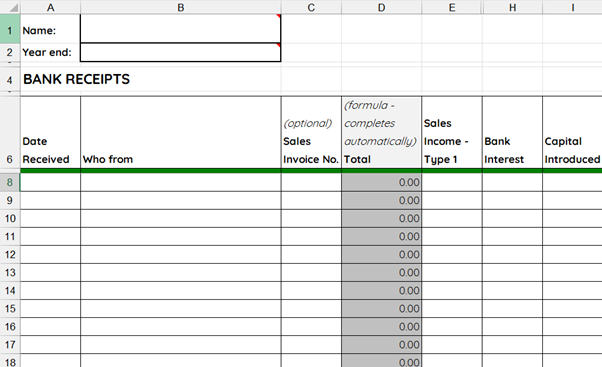

Can I still use spreadsheets to keep my bookkeeping records?

The short answer is – yes, you can – but here are some factors to consider: Which tax system are you in? If you’re in Self Assessment, spreadsheets are absolutely[…]

Read more“Clients should never be allowed near their own bookkeeping!”

I disagree. If you run your own business, it should be your choice who does your bookkeeping. Doing it yourself might be the right decision for you, it might not[…]

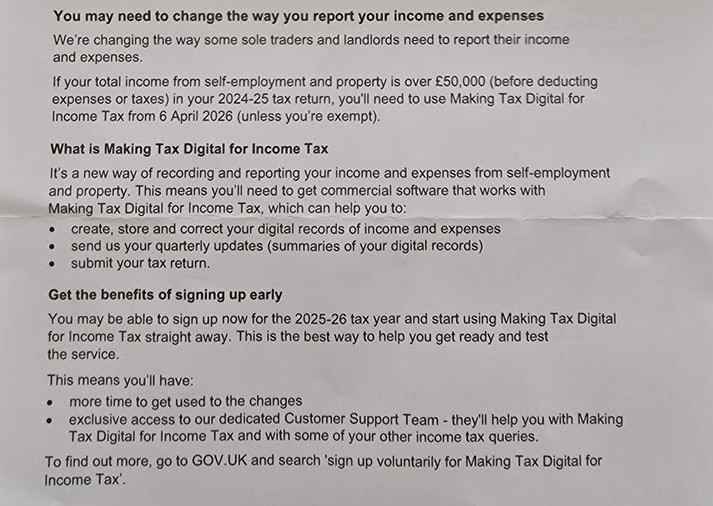

Read moreHave you received a letter from HMRC about Making Tax Digital for Income Tax?

Self-employed individuals and landlords who showed a gross income of over £50,000 on their 2024-25 tax return – that’s before deducting expenses – must comply with the new Making Tax[…]

Read moreA self-employed view of the 2025 Budget

The run up to yesterday’s budget was chaotic. Widespread scaremongering about tax rises and VAT registration threshold drops caused a lot of uncertainty, but the 2025 Autumn Budget could have[…]

Read more